Provision & Protection

Owning your own business often means financial insecurity. We show you how you can provide for the future and protect yourself.

How is this relevant to me?

When you start a new business, you have a lot on your plate and it's easy to forget about your own provisions and protection. However, the financial risk is enormous depending on the legal form and structure of the company! If you don't take care, you could be left with nothing after an accident, for example. A certain part of your income should therefore be used from the beginning to provide for financial security in old age and to cover possible risks, such as accident or illness.

In order for you to master this part of the start-up journey in the best possible way, we have compiled all the important information on provision, protection and asset growth for entrepreneurs here.

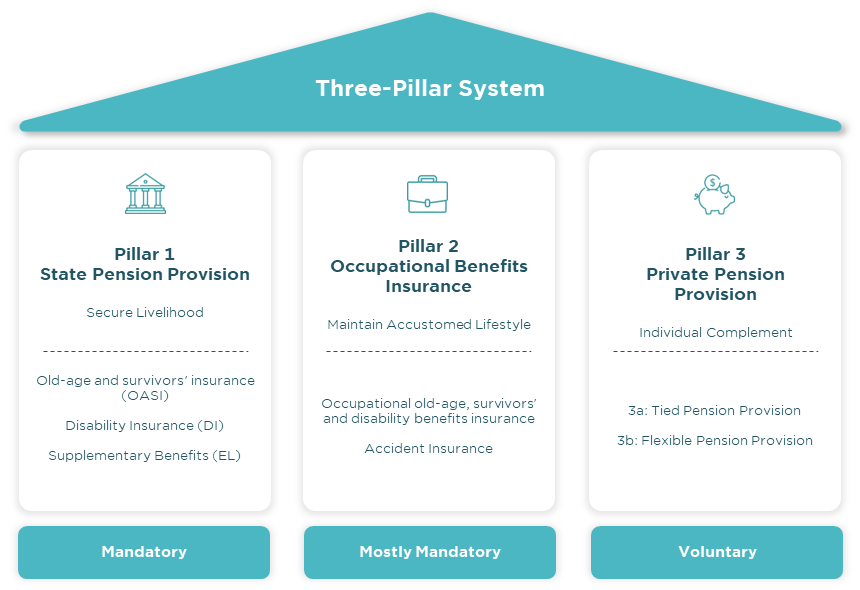

The 3-pillar principle of provision

In Switzerland, there is the so-called 3-pillar principle, which is also intended to provide founders with appropriate protection against risks in everyday working life and to offer possibilities for old-age provision. The area of old-age provision is divided into the following 3 pillars:

Pillar 1: State Provision

The old-age, survivors' and disability insurance (AHV/IV), together with the so-called supplementary benefits (EL), forms the first pillar of state pension provision in Switzerland. The aim is to secure one's own financial existence. All persons living or working in Switzerland are required to pay AHV contributions from the age of 18 or 21.

Employers and employees each pay half of the contributions. If you also have employees in your new company, you will also have to pay these employer contributions.

Pillar 2: Occupational Provision

In colloquial language, the term "pension fund" is often used in the context of occupational pension provision (BVG). The benefits of the 2nd pillar supplement the benefits of the AHV/IV in old age, in the event of disability or death of the employee. The aim of the 2nd pillar, together with the 1st pillar, is to secure the cost of living.

In addition to occupational benefits, accident insurance (UVG) covers short- and long-term accident benefits.

Employees are always insured against occupational accidents and diseases through the employer. If they work more than 8 hours per week, they must also be insured against non-occupational accidents (e.g. cruciate ligament rupture during football match).

Daily sickness benefit insurance is not compulsory, but it protects employers from considerable financial consequences in the event of absence due to illness.

Pillar 3: Private Provision

The 3rd pillar deals with private pension provision in Switzerland and is divided into pillars 3a and 3b:

Tied pension provision (pillar 3a) is a private form of pension provision that is subsidised by the state. Your contributions to Pillar 3a are limited in amount, but are tax-deductible. It is important to note that the saved capital can only be withdrawn before retirement under certain circumstances (e.g. self-employment, home ownership promotion, emigration).

The free pension plan (pillar 3b) includes all private savings and investments that are not in pillar 3a. Here you have more freedom over your money.

Our Partners

FAQs

How am I insured after founding a company?

Can I withdraw my pension fund at the time of incorporation?

What happens if I employ someone?

Employees can be employed in all legal forms. Be aware, however, that different rules may apply to employees than to yourself. If you have a sole proprietorship, you yourself are exempt from many contribution obligations. However, you must insure your employees properly as soon as they earn a certain amount. If you do not comply with this, you will quickly become privately liable.

Do you need support with pension provision and insurance?

Benefit from a free consultation on various pension and insurance topics with our Mobiliar advisors.

No obligation

Personal & individual consultation

Protection of you and your company

Attractive conditions for young companies