How to Set Up Your Accounting

Starting your own company with a sound accounting system will save you headaches in the long run. We’ll show you how to get started.

How to set up your accounting

Accounting is not only the basis for calculating the business taxes you will have to pay.

Proper accounting is also how you can keep an overview of your company: Do you have enough cash? How much money do your customers (i.e. your debtors) owe you, or do you owe your suppliers (i.e. your creditors)?

The accounting system must always comply with the requirements of tax and commercial law. Banks can use the data from the accounting system, for example to assess your creditworthiness if you subsequently need a business loan or a loan to grow your company.

This section explains at what point you need to maintain an accounting system and how you can do this the easiest way.

Keeping your finances under control with the help of accounting

Business owners in Switzerland are generally required by law to prepare proper accounts. Even founders who have not yet been entered in the commercial register have to document revenue and expenditure using a simplified accounting system and keep the documentation with the corresponding vouchers for 10 years in case of a tax audit.

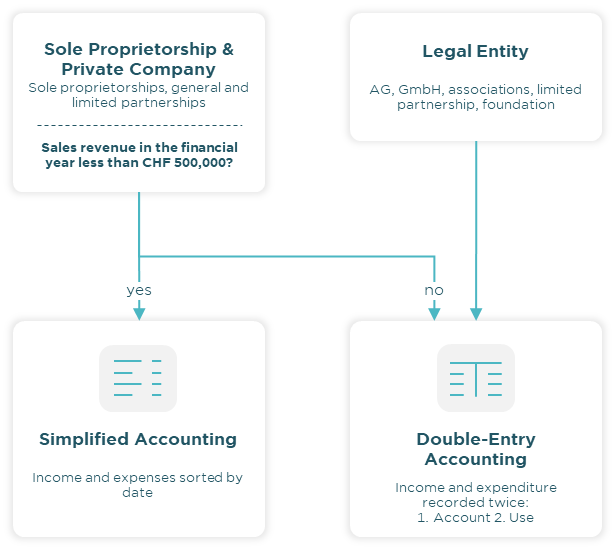

The form and extent depend on the size and type of your company: Private companies that are entered in the commercial register and incorporated companies are required to use “double-entry bookkeeping” for their accounting system. But what is the difference between simplified and double-entry accounting?

Simplified (cash-basis) accounting

All receipts and expenditures are recorded by date. You only record that you have received or spent money.

Double-entry accounting

All receipts and expenditures are recorded twice. You start by recording the account where the movement happened (e.g. bank account or cash). You then record why the money was spent, e.g. for flights, hotels, office supplies, etc.

Double-entry accounting is not mandatory for all Swiss companies. The following companies are required to use double-entry accounting:

- Gesellschaften mit beschränkter Haftung (GmbH) (Swiss private limited companies)

- Aktiengesellschaften (AG) (Swiss public limited companies)

- Sole proprietorships and partnerships with annual revenue of at least CHF 500’000

Which companies are obliged to keep accounts?

Why does a proper accounting system make sense?

Correct accounting is a requirement or otherwise needed for all business management reports. For example, you can see all outstanding invoices and liabilities in your accounting as well as review which receivables your customers still owe you. You can analyse who your best customers are or which suppliers make the most revenue with you. A precise accounting system also gives you an overview of your entire business assets, allowing you to identify potential liquidity bottlenecks at an early stage.

The financial accounting system documents all business transactions. It includes all your receipts and payments from purchases and sales, as well as your outstanding liabilities. The accounting system also records the investments you make and the related depreciation and amortisation charges. Additionally, the accounting system allows you to make period-specific comparisons between individual months, quarters and financial years. At the same time, it helps you work out how much profit your business is making.

Founders generally have four ways to organise their accounting system:

The accounting system also includes financial accounting, value added tax (VAT) accounting, financial statements and taxes. Especially at the beginning, you probably have no inclination and even less time to take care of your accounting system. And if you don’t start your business as a team and have your own accounting staff from the outset, the only real option is to outsource your accounting to an external accounting firm.

Completely self-sufficient

You have knowledge of accounting and handle all of the bookkeeping yourself.

Delegating to staff

You have the right staff to handle the bookkeeping for you.

Outsourcing to an accounting firm

You outsource the entire accounting system to an accounting firm.

Partial outsourcing

You are only responsible for recording the individual accounting transactions and outsource financial statement preparation, VAT accounting and your tax return to an accounting firm.

Our Partners

Do you need support with accounting?

Are you looking for the best tool for your accounting system? Check out the software solution from our partner bexio, which offers a 50% discount in the first year as well as many free events and webinars.

Non-binding

Personal & individual advice

Attractive conditions for young companies